By Adrian Ash

Behold the sad case of the poor British worker and saver…

PEOPLE BUY GOLD when they fear inflation ahead. But they also buy gold when inflation arrives and starts eating into their savings – which is just what it’s done during the last decade.

- Take the poor UK cash saver, for instance. Oh sure – the London press pretty much agreed that “inflation eased off” when the latest data were released on Tuesday.

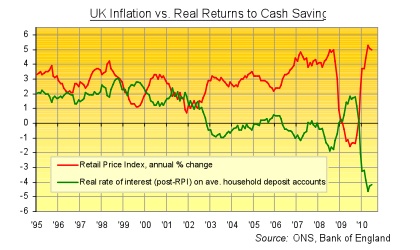

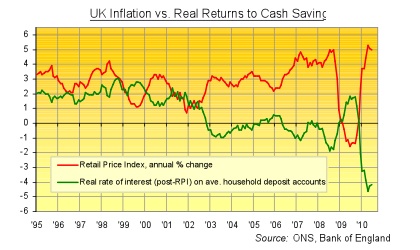

- But as BullionVault never tires of reminding people, it’s worth putting such a “dip” into context, starting with its impact on real rates of interest…

- #1. On the old Retail Price Index, UK household deposit accounts have lost value – after inflation – in 57 of the 120 months since July 2000. Gold priced in Sterling has risen by 332%;

- #2. Since Mervyn King moved from deputy to governor of the Bank of England in June 2003, the Pound has lost 15% of its domestic purchasing power on the Consumer Price Index, and lost very nearly one-fifth on the RPI. Gold’s UK purchasing power has risen by 265% on the CPI, and by 258% on the RPI;

- #3. Over the last half-decade, CPI inflation has now been above the Bank of England’s “symmetrical target” of 2.0% p.a. in 46 out of 60 months. Gold priced in Sterling has risen by 220% since July 2005;

- #4. Since the Bank began slashing interest rates in response to the Northern Rock crisis of autumn 2007, CPI has matched or exceeded 3.0% – the upper tolerance of the Bank’s price stability mandate – in 17 out of 31 months. Gold priced in Sterling has risen by 70%;

- #5. Not since May 1980 has the Bank’s base rate lagged RPI inflation by such a wide margin. Inflation was then peaking at almost 22% per year. On the quarterly average, base rate was lower – in real terms – between April and June 2010 than at any time since the fourth quarter of 1977.

- Real returns to cash aside, however, this apparently “gentle” inflation isn’t just hurting savers – those rentiers whom John Maynard Keynes longed to euthanize, and whom his self-declared reincarnation Paul Krugman thinks should be forced to spend! Spend! SPEND!

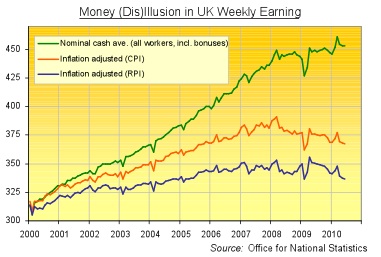

- New data today showed UK unemployment dipping slightly to 7.8% in May, but the drop was driven by a jump in self-employed and part-time workers. Naturally, they earn less than their permanent and full-time colleagues, but fact is, real wages have long been stagnant, and have begun falling, across the UK economy.

- “Millions of workers will suffer effective pay cuts and a fall in their standard of living for the next four years,” says The Telegraph, quoting one of the new government’s new Office for Budget Responsibility (OBR) members, speaking this week to MPs in a parliamentary committee.

- Let’s not worry Westminster with it (let alone Fleet or Threadneedle Streets), but millions of workers have already suffered effective pay cuts and a fall in their standard of living.

- #6. The average UK wage is now £117 lower per week in real terms than if the cost-of-living on the Retail Price Index hadn’t risen since Jan. 2000;

- #7. Adjusted for the less aggressive (and ever-more mandated) benchmark of consumer price inflation, average earnings fell in May for the 15th in 25 months.

- #8. From the CPI-adjusted peak of March 2008, average UK wages have now shrunk by 6% to stand unchanged from five years ago.

- Glancing back at the last decade today, the average UK worker might guess what the average gold buyer feared way back when. That the credit boom – with its lifetime mortgages, spiralling credit-card limits and plunging savings rate – was just a classic case of money illusion.

Adrian Ash

Gold price chart, no delay | Buy gold online at live prices

Formerly City correspondent for The Daily Reckoning in London and head of editorial at the UK’s leading financial advisory for private investors, Adrian Ash is the editor of Gold News and head of research at BullionVault – winner of the Queen’s Award for Enterprise Innovation, 2009 – where you can buy gold today vaulted in Zurich on $3 spreads and 0.8% dealing fees.

(c) BullionVault 2010

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it.

[…] Money Disillusion: 8 Ugly Facts About Inflation – The Midas Touch […]

My partner and I really enjoyed reading this blog post, I was just itching to know do you trade featured posts? I am always trying to find someone to make trades with and merely thought I would ask.