Can Gold Plating Be Profitable? Breaking Down the Business Model

Goldgenie has built a recognizable luxury niche by turning ordinary tech and luxury items iPhones, watches, headphones, bicycles into high-margin, gold-finished statements. The visible glamour makes for great headlines, but is the underlying Gold Plating Business genuinely profitable? This article breaks down the economics, revenue levers, costs, scale factors, and risks so you can see where profit comes from (and where it can slip away).

Executive summary

Goldgenie monetizes perceived exclusivity rather than intrinsic commodity value. Profitability comes from (1) large markups on standard products, (2) premium customization fees, (3) limited-edition scarcity, and (4) ancillary services (warranty, concierge, shipping). Low variable material costs for plating combined with high price points produce healthy gross margins but fixed costs (craft labor, studio overhead, marketing, intellectual property, compliance, and shipping/insurance) and reputation risk can compress net margins if volume, pricing discipline, or brand cachet weaken.

How Goldgenie’s business model generates revenue

- Product premiuming: Goldgenie commonly takes mass-market devices (e.g., an iPhone) and sells gold-finished versions for multiples of the base device price. The premium is what customers pay for craftsmanship, exclusivity, and the brand. These premiums are often several thousand dollars per unit on top of the device’s retail price.

- Customization and service fees: Bespoke requests (engraving, diamonds, limited-edition runs) command additional fees. These bespoke services often require skilled hand-finishing, allowing the company to charge labor-heavy margins.

- Limited editions & scarcity: Numbered runs or celebrity-endorsed pieces allow prices to spike and can create urgency and collectibility again boosting margins per unit.

- Franchise/franchise-like expansion and B2B deals: Licensing, master franchises, and partnerships (corporate gifts, co-branded projects) diversify revenue beyond direct retail.

Cost structure what eats margin

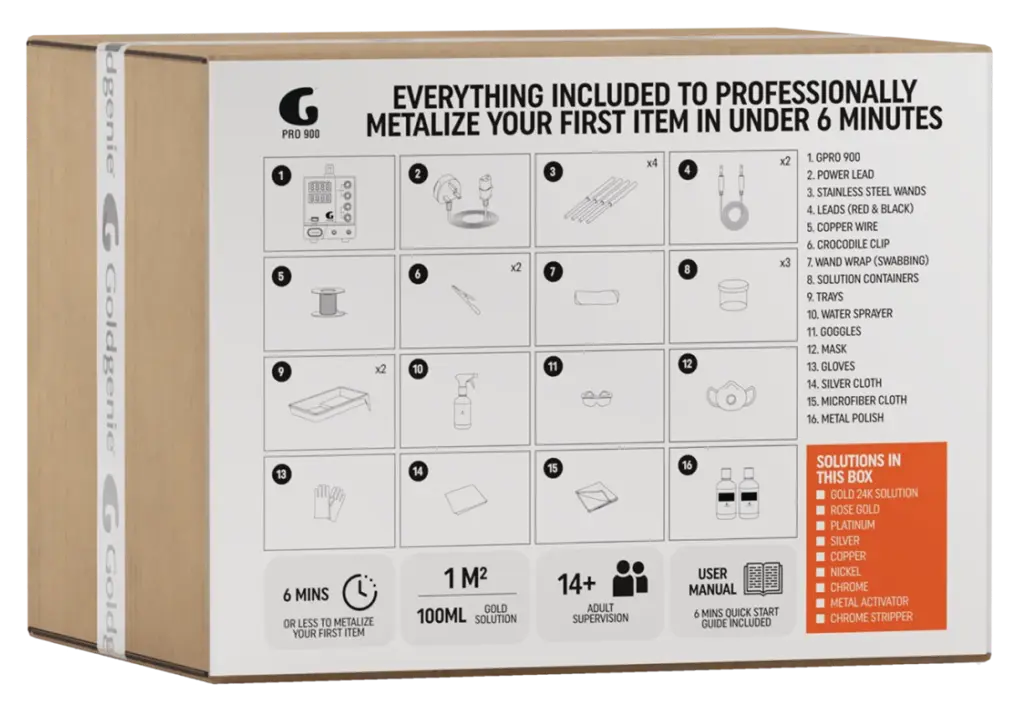

- Direct materials. Ironically, the raw gold used for plating is a relatively small fraction of the retail price. Gold Plating typically applies a thin layer; even when 24k gold is used, the grams of gold per item can be low relative to the final price. The main materials cost items are gold (or other precious metals), consumables for finishing, and packaging.

- Labor and craftsmanship. Hand finishing, polishing, and quality-control are labor-intensive. Skilled artisans increase quality but add to cost-per-piece.

- Product acquisition. If Goldgenie buys devices wholesale to custom-finish them, that acquisition cost must be covered. In some models they ask customers to provide a device or they sell pre-finished devices.

- Marketing & brand. Luxury positioning relies on PR, influencer placements, high-quality photography, trade shows, and partnerships. These are recurring and more fixed than per-unit.

- Shipping, insurance & warranty. High-value items need insured shipping and lifetime or extended warranties that add to operating costs.

Key profitability levers

- Pricing power: the brand’s ability to command large markups is the single most important lever. Strong PR coverage, celebrity placements, and a reputation for craftsmanship allow higher P.

- Cost control: negotiating device procurement, optimizing plating processes, and controlling labor costs without degrading quality raise margins.

- Upsells & add-ons: diamonds, personalization, extended warranties, and concierge delivery raise average order value (AOV).

- Channel mix: direct-to-consumer online sales minimize retail cuts; franchising and corporate deals can provide high-margin, lower-touch revenue.

- Operational scale: fixed costs (studio rent, elite staff) amortize across more units as volume grows; however, volume also risks brand dilution if exclusivity is harmed.

Risks and margin pressures

- Reputation & authenticity risk: If quality complaints, negative reviews, or ethical sourcing questions arise, the brand premium and therefore price power can evaporate quickly.

- Competitive pressure: New entrants or imitators offering cheaper alternatives can undercut margins.

- Regulatory/insurance costs: High-value shipping, duties for precious metals, and insurance claims can spike unexpected costs.

- Customer acquisition cost (CAC): Luxury buyers are a niche that may require expensive marketing; if CAC rises, net margins shrink.

- Inventory & obsolescence: For tech items, product cycles are short. Holding inventory of specific device models can become risky.

Evidence from the market

Publicly available offerings and press show Goldgenie sells plated devices and limited editions at multi-thousand-dollar prices, demonstrating the principle of high price-per-unit rather than high-volume commodity sales. The company also pursues franchise and master-franchise models and has press positioning as a long-established luxury finisher — all consistent with a margin-first luxury model.

What profitability looks like at scale

If brand power remains strong and volume increases prudently (especially via corporate sales, franchising, and limited-edition drops), the business can enjoy high gross margins and attractive operating leverage. However, to turn those gross margins into healthy net profit, management must keep CAC and overheads in check and protect the brand equity that allows pricing to stay elevated.

Conclusion

Gold plating as a business is profitable when it sells luxury, not raw metal. The raw material cost (gold) often represents a small portion of the final retail price; profit comes from craftsmanship, brand, scarcity, and service. That said, the model is fragile: profit depends on disciplined pricing, flawless execution, and preserved exclusivity. When those pillars hold, Gold-Plating Businesses like Goldgenie can generate strong margins; when they break, the economics can look very different.